BTV AGM: Checking In on Embedded Fintech

Back in our Fund I pitch deck, we said "everything is fintech." We even have a big neon sign in our office that says it!

The idea was that fintech would become an increasingly important component of successful businesses that others don't traditionally think of as fintech companies.

The Original Thesis

Vertical solutions beat horizontal solutions. Vertical software wins because it is built for the real workflows of a specific industry. A restaurant platform understands restaurants in ways a generic tool never can.

Vertical solutions become operating systems. These products aren't just point solutions. They become the operating system the business runs on. If you're a landlord, you aren't using property management software just for tenant tracking; you're running your entire business through it.

Financial services belong inside the operating system. As the operating system, vertical platforms have deep insight into their customers' businesses. That gives them two advantages traditional financial institutions don't have: superior risk pricing and an existing distribution channel.

That Future Is Here

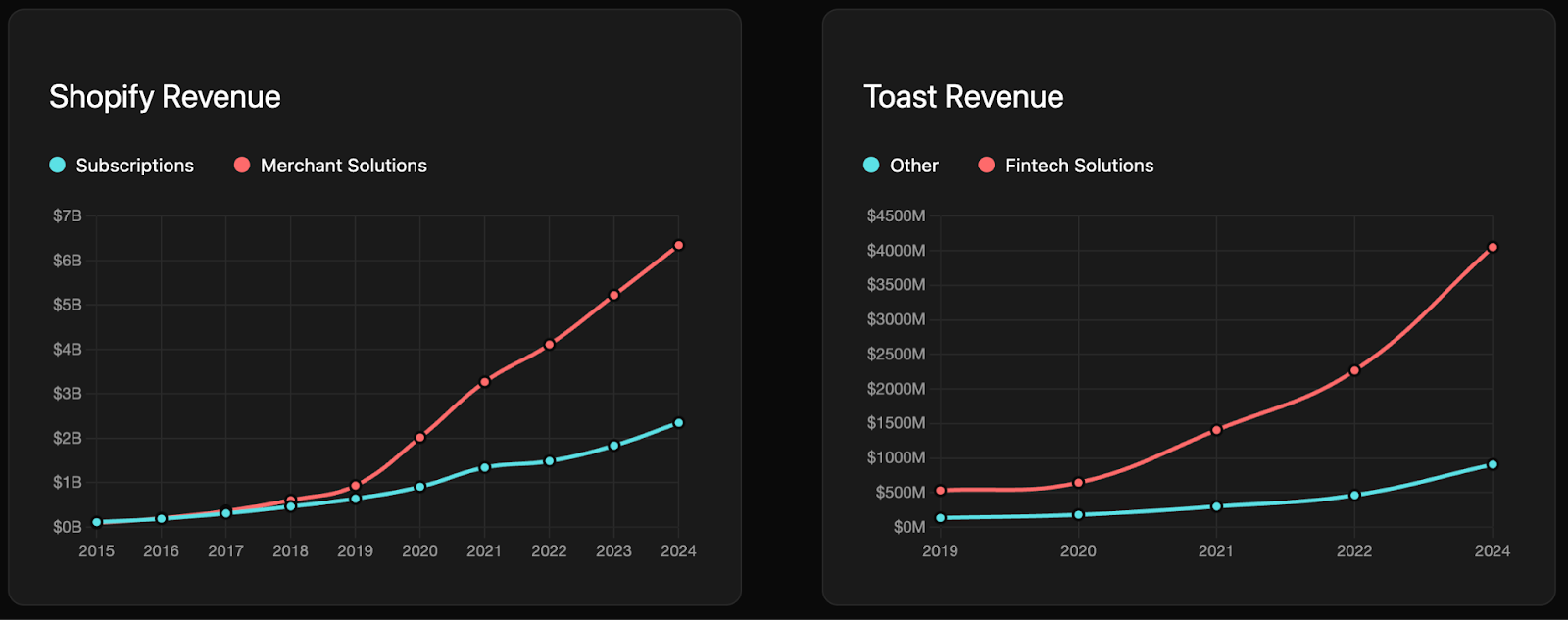

Modern restaurant owners no longer go to Wells Fargo to get a Verifone payment terminal to accept payments. They go to Toast.

Savvy landlords do not stand in line at Chase to deposit checks or get loans. They use Yardi.

Fintech is not a narrow business model. It is a tool to improve business models across every vertical. Some of the biggest software companies in the world are also fintech companies. Toast and Shopify are not exceptions. They are the blueprint.

It's a Win-Win-Win

This model works because it creates value across the stack.

Business owners get a better experience with financial services embedded into tools they already use.

Software platforms add new revenue streams and expand customer lifetime value through payments, lending, and banking.

Financial service providers gain proprietary data for better underwriting and a far more efficient path for customer acquisition.

BTV Embedded Investments

We've been investing in this thesis since the start of Fund I:

Unit (2019) was our first embedded fintech investment. They are Series C funded and enable banking products for companies like Wix, Baselane, and Relay. They're now expanding into capital and lending.

Salsa (2021) embeds payroll for vertical SaaS platforms including GlossGenius, HoneyBook, and Jane. They raised a Series A earlier this year.

Layer (2023) embeds accounting and works with Nav, Dripos, and Moxie. They're expanding into tax planning and raised a seed earlier this year.

Sticker (2025) embeds procurement and is our most recent investment in the thesis as we continue to double down.

Beyond our investments, we've seen embedded lending companies like Parafin and OatFi, embedded insurance companies like Authentic, and embedded payments companies like Rainforest and Tilled.

What We’ve Learned

Embedded fintech is fundamentally a multi-step sale. First you win the platform. Then you win adoption across its customers. The best companies execute both.

We've learned a lot from watching Unit grow. Their "jobs to be done" come down to a few core principles:

Maximize end-user value. The key question isn't whether the platform wants your product. It's whether their customers will use it. If it doesn't improve the end-user experience, distribution won't matter.

Make launching simple. Getting live usage requires frictionless integration. Do everything you can to make it easy on the partner. Unit's newest products can go live in weeks with a single line of code.

Help them succeed. Once a platform is live, the focus shifts to adoption and revenue. Their success is your success.

Focus on profitability. You need to think about your profitability, but more importantly, your customer's profitability.

Why We're Even More Excited Now

We're still early in this wave, but two dynamics make us increasingly excited.

Distribution Advantage

Embedding financial services inside software remains one of the most powerful distribution models in fintech.

This tailwind is getting stronger as vertical ERPs proliferate. Every industry now has its own system of record that bundles CRM, payments, payroll, inventory, and operations into a single workflow. These platforms are becoming the daily home screen for SMBs.

As vertical ERPs replace patchwork tool stacks, they accumulate richer data and tighter control over distribution. That makes them the natural place for accounting, banking, lending, and insurance to live. When the ERP is the front door, embedded fintech becomes the default path to the customer.

Circumventing the Incumbents

Some markets are so dominated that competing looks impossible. SMB accounting is one of them. QuickBooks owns the category in the US, and very few challengers have made real progress. We think Layer can now, in part thanks to AI. They win by:

- Native distribution. SMBs already live inside vertical platforms like Toast and Jobber. Layer embeds directly into those daily workflows.

- A meaningfully better product. AI-driven bookkeeping automates categorization, reconciliation, and anomaly detection. It is faster, cheaper, and more accurate.

This drives zero-CAC adoption and lock-in because platforms can activate accounting with a toggle.

This shift isn't only about building better financial tools. It's about changing how businesses access financial services. It is a shift from standalone accounting software to embedded infrastructure inside the systems where work already happens.

It's the future we anticipated six years ago. And we are still just getting started!