1Q23 Newsletter

👋 Hello, It's BTV

Welcome back to our quarterly newsletter.

Q1 was a truly action-packed quarter. But our most exciting update is that Sheel got married at a Taco Bell… in the metaverse… this is not a joke. Check it out!

Our second most exciting update is...

🥁 Drumroll Please...

We JUST ANNOUNCED that we are launching a fintech-focused accelerator! Check out our public launch and the application to join!

So, if you come across any great founders who are thinking about building something in fintech, but could use help getting off the ground, please send them our way!

Sheel and Jake previously ran the 500 Fintech accelerator, which backed companies like Chipper Cash (at one point the fastest-growing unicorn in Africa), Ethic, Albert, Kin Insurance, and Ledger Investing. And we want to bring the accelerator experience back under the BTV organization.

Our goal is to accelerate learning curves, help founders avoid the unique pitfalls of fintech, and get to market much faster and much stronger than they might otherwise.

Accelerator founders would not only get the usual BTV operational support from Jake, Sheel, the rest of our team of fintech experts, and our LPs, but we'd pair them up with a mentor for a few months (generally, a founder or operator who we think is uniquely suited to what they need). We'll be bringing in experts in relevant fields to do office hours, and we plan to offer other support with things like recruiting, growth, sales, office space to work with other founders here in San Francisco (and maybe NYC in the future), legal, finance, etc.

We'll wrap up with a Demo Day after our AGM on October 12th to showcase our accelerator founders to a bunch of VCs and angels, including our favorite fintech investors!

📈 BTV Portfolio Updates

💰 Fundraising

Plumery announced their $4.5 million seed funding round. To learn more about why we invested, check out some thoughts from Nihar!

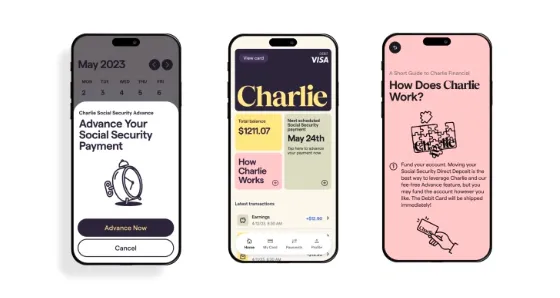

Charlie announced their $7.5 million seed funding round. To learn more about why we invested, check out some thoughts from Jake!

Salsa announced their $10 million funding round. To learn more about why we invested, check out some thoughts from Sheel!

Paytrix announced their $18.3 million Series A funding round led by Unusual Ventures, Motive Partners, and Bain Capital Ventures. Check out some words about the round from the Paytrix Co-Founders, Aran and Eddie, and a blog post from Bain Capital Ventures on why they co-led the round.

Monnai announced their $6.5 million Series A funding round led by Tiger.

📰 In the News

Paytrix:

Obtained a Payments Institution License in the UK, authorizing them to provide UK businesses with foreign exchange, remittance, and local payment services.

Chipper Cash:

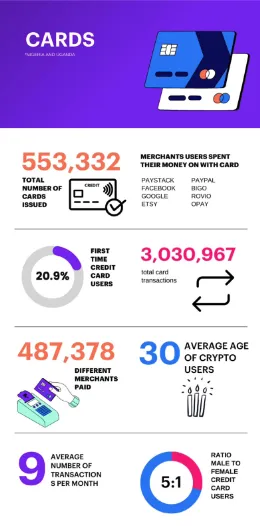

Announced that their virtual cards scheme in Africa has now issued over 550,000 Visa cards.

Collective:

Published the first edition of the Collective B1 Economics Report: “a semi-annual look into how the economy is going for American Businesses-of-One.”

Selfbook:

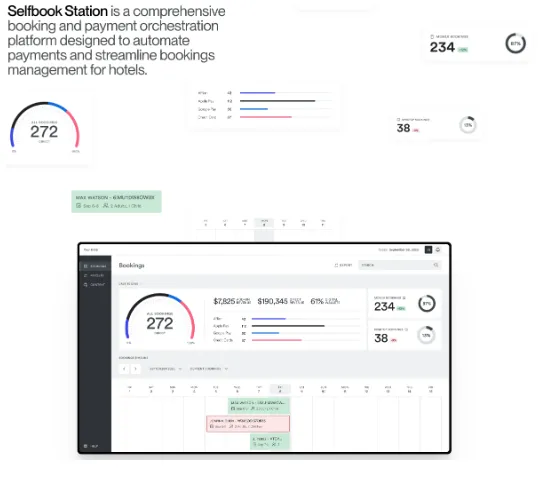

Released a new product, Station, a hub for hotel booking and payment management.

The “system automatically captures and processes all booking and payment data processed through its Direct checkout interface and Express payment rails, so all information is securely handled in one environment.”

Unit:

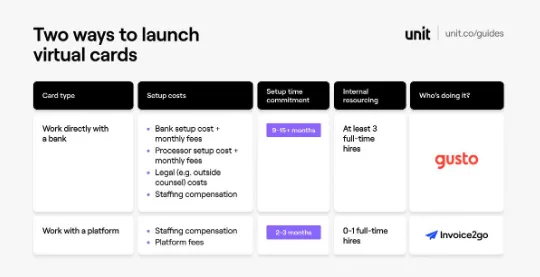

- Released new guides on virtual cards, ACH payments, and PCI DSS compliance.

- Announced that they’re releasing new corporate bank accounts that may be eligible for up to $150 million in FDIC insurance through a sweep network.

- Released several new features, including recurring ACH debit paymentsand transaction enrichment.

Caplight:

Was featured in an article published by Techcrunch about how secondary market trackers are lighting up a traditionally dark deal environment.

CloudTrucks:

Launched a new product, Starter, a business management solution for owner-operators and small fleets.

The product “equips owner-operators and small fleets who have their own authority with all of the essential capabilities they need to run their business and more, including the ability to find and book loads, generate invoices, track finances and identify valuable markets and routes – all in one, simple application.”

FarmRaise:

Launched a new product, Tracks, which helps farmers do their taxes.

The product makes it easy to snap and tag transactions from the field so that farmers can export a clean and organized ledger for their accountant, saving them money and time.

Curant:

Rebranded from FreightPay to Curant!

Mercury:

- Launched a new product, Vault, that enables customers to access FDIC insurance for up to $3 million in deposits (updated to $5 million shortly after the initial announcement).

- Partnered with Stripe Atlas to make it easier for startups to set up their companies. The partnership makes it “faster to set up business banking as soon as a company incorporates, even before the IRS assigns their tax ID (EIN).”

Ramp:

Reported that it “saw revenue grow by 4x last year” due to “a desire on the part of companies of all sizes and stages seeking to save money by managing their spend better.”

Nova Credit:

Expanded its partnership with American Express to enable newcomers to the U.S. from South Korea and Switzerland to apply for American Express cards.

American Express will “leverage Nova Credit’s Credit Passport® solution to instantly translate credit records from South Korea and Switzerland’s credit reporting agencies into a U.S.-equivalent credit report and score, helping the company make even more effective application decisions for those who are new-to-country.”

Hardfin:

Published a blog post defining hardware-as-a-service (HaaS).

LogRock:

Launched a recruiting feature that will help small fleets integrate their compliance and recruiting tools.

📢 BTV in the Spotlight

Podcasts and articles featuring our portfolio founders:

- Nadia (Tome) was on This Week in Fintech’s podcast, Beyond Two Percent, talking about how finance and technology go beyond “intersectionality.”

- Stephen (Tome) was on Startup Huddle, talking about his journey from Minnesota, to Stanford, to leading operations at a VC fund, and to founding Tome to bridge the gap between complex legal contracts and the requirements of everyday business deals.

- Ham (Chipper Cash) was on CNN, talking about choices over expansion amid volatility in the banking system, and how Chipper Card worked during the Nigerian cash crunch.

- Amanda (Unit) was on Performline’s COMPLY podcast, talking about how compliance can be a competitive advantage.

- David (Unit), Khalid (Selfbook), and Daniel (Coast) spoke at the 2023 Wharton Fintech Conference, talking about embedded finance and why everything is fintech.

- Mark (Amitruck) spoke at The Africa Tech Summit Nairobi on how logistics can transform the continent.

- Brennan (Butter) was on Keys to the Shop, talking about insurance and risk mitigation for people running coffee shops.

- Zack (Hardfin) was on The Engine Room, talking about considering risk when evaluating the cost savings of automation.

- Ale (Mendel) wrote a piece for Mexico Business News, talking about how M&A has accelerated the growth of startups in Latin America.

- Pierre (Monnai) was interviewed by TechNode Global, talking about his insights on the opportunities that lie ahead for Monnai as the company continues to grow and expand its presence, particularly in the Southeast Asian market.

- Itai (Unit) was on the Fintech Leaders podcast, talking about founder lessons, navigating the complex world of fintech partnerships, learning from successes and failures of building companies worldwide and lots more!

- Hunter (LogRock) was on WHAT THE TRUCK?!?, talking about their new recruiting feature as the company continues to grow its carrier compliance offering.

- Ema (Pave) was on the Finovate Podcast, talking about how Pave's product can be used to allow consumer fintechs to offer financial services to people who have historically been excluded from accessing these services.

- Khalid (Selfbook) was the keynote speaker at the Forbes Travel Guide Summit, sharing his thoughts about how hotels can harness invisible technology to enhance human connection.

Our BTV team also spent some time in the spotlight:

- Sheel was on The High Flyers Podcast, talking about his Indian/American identity, living on $1 a day, the state of fintech today, metaverse weddings, living with Airbnb's Brian Chesky, and more.

- Sheel spoke on a panel at Fintech MeetUp, talking about the future of fintech infrastructure.

- Sheel sat down with FF News at Fintech MeetUp, talking about how technology and digital innovation will help make finance more accessible.

- Sheel was on the Rebank podcast, talking about how fintech VC has changed over the last few years, the state of the early-stage market today, what separates elite seed funds from others, building social capital as an investor, the investment areas BTV is currently focused on, and more.

- Sheel was the featured speaker at a dinner at Fintech MeetUp, talking about the shock of the SVB collapse, how he helped his portfolio startups manage the crisis, the future of fintech and banking partnerships, and the challenges he sees for the next decade in venture capital.

- JC moderated a panel on building the next decade of consumer finance by leveraging real-time data and cash flow forecasting at Fintech MeetUp. Check out the key insights discussed during the panel here.

- Jake spoke at the 2023 Wharton Fintech Conference, talking about how fintech will navigate the turbulence of the current market.

- Sheel spoke on Nasdaq TradeTalks from the Empire Fintech Conference to discuss the funding environment in the fintech space.

- Nihar hosted a16z’s Angela Strange on the Wharton Fintech Podcast.

- Sheel featured in Good Work’s latest Case Study, which answered the important question: what do venture capitalists actually do?

- Sheel was on 1947 VC, talking about how Indian startups are sharing emerging markets.

- Sheel was on the Alt Goes Mainstream by The AGM Collective podcast, talking about the challenges and highlights of building a first-time fund into a first call FinTech VC.

- Jake was on the Asaasins podcast, talking about founding NerdWallet, when to hire a replacement, and the future of fintech.

- Sheel pitched Better Tomorrow Ventures to founders at the Reverse Investor Pitch event at NYC Fintech Week.

🤙 Community

Community was happening in Q1!

Our founder community is continuing to build, and it’s marvelous to support and witness. We love being our founder’s first call; but if it isn’t us, it’s awesome to see them leaning on each other more and more.

Part of strengthening our community is by regularly hosting BTV founder events, like founder networking dinners in specific geographies. If you're a BTV founder, let us know which cities we should host these in!

On the event front, Jake and Lauren hosted a happy hour in LA for all of our fintech friends during the Upfront Summit. ‘Twas lovely.

Then, Sheel and JC rented out the Taco Bell in Vegas at Fintech Meetup! There was unlimited, A+ food and drink and, obviously, immaculate vibes.

We closed out the quarter by going to Austin for a team retreat!

Naturally, we kicked off the trip by hosting a happy hour for all of our closest fintech friends (pictured below).

Then, between brainstorming sessions on our next big thing 🤫, we had a blast sweating at Soulcycle, swimming in the springs at Barton, eating BBQ, and giving each other mullets. As Sheel said, it really slapped.

Before NY Fintech Week, we gathered our BTVeloved NYC Founders together for dinner. The hummus and good convos were flowing — so much that we forgot to snap a pic.

Later in the week, we co-hosted a fintech carriage house breakfast with the team over at Greylock for all of our NYC fintech friends!

💪 Talent

Many BTV companies are still growing and hiring! And we continue to meet with lots of fintech talent who we get to introduce to our portfolio.

We've also been forming relationships with fintech clubs at select campuses. Yoni and Sheel each recently presented at UC Berkeley’s Haas School of Business: Yoni covered recruiting for early-stage companies, Sheel covered BTV and a career in venture. And Nihar is scheduled to join a panel for the fintech club at Northwestern’s Kellogg School of Management.

We’re working to establish the BTV portfolio as a home for fintech talent. To that end, we’re going to start hosting in-person networking and meet-ups in key geographies. Interested? Get on the invite lists here!

📚Good Reads

We recommend checking out:

- Bessemer’s post, The Five Waves of Fintech, which reflects on how changes in technology, regulation, customer expectations, and macroeconomics transformed financial services over the last few decades

- Foundation Capital’s post, A Local’s Guide to Fintech Investing

- Howard Marks’s memo on the Lessons from Silicon Valley Bank

🗓️ Coming Up - Let's Hang!

Here’s where you’ll find Team BTV over the next few months:

- Week of May 29:

- Sheel → Italy

- Jake → San Francisco, leading our #TechWeek event with a16z

- Week of June 5:

- Sheel and Nihar → Amsterdam for Money 2020 Europe

- Jake and Lauren → Los Angeles, leading our #TechWeek event with a16z

- Week of June 12: Sheel and Nihar → London

- Week of June 26: Sheel → Toronto for Collision

- June 30: Sheel → Stockholm

Made it this far? We appreciate you. Feel free to hit reply and tell us what you want from this newsletter so we can be better tomorrow (and next quarter).

Until next time,

Team BTV