2Q23 Newsletter

👋 Hello, It's BTV

Welcome back to our quarterly newsletter.

Let’s get right into it. Q2 was non-stop. Our team was hands-on all quarter, spending most of our time setting up for our accelerator, The Mint!

🚀 The Mint

As we mentioned in our last newsletter, we launched The Mint, a fintech-focused accelerator! Since then, we’ve been all hands on deck creating an awesome program for our companies.

The program doesn’t offer a set curriculum, per se. We're more focused on "people helping people,” figuring out what each company needs, then matching them with people best suited to help with those needs. It includes fireside chats, office hours, expert talks, and tailored content...in the first few weeks of the program, we had Tim Chen and Drew Houston come in to talk to our founders! That said, most of it is about curated, hands-on help.

Want to get involved? Hit reply and let us know! Want to attend Demo Day? RSVP here.

The program officially kicked off on August 1. Check out our first batch of companies:

Easy Expense is building Ramp for SMB owners, offering savings for micro-SMBs by continuously labeling thousands in tax-ready deductions. The founding team comes from Invoice Simple and Easy Invoice.

Level is building TurboTax for injury claims to better serve customers throughout their post-car accident journey, allowing an injured party to create a demand package and work directly with insurers to settle cases. The founding team comes from our prior portfolio company, ClearCover, and Microsoft.

Ponte is building a recruiting-and-hiring platform for the hospitality industry that connects companies in the US with qualified immigrant workers. The founding team comes from Addi, through our LatAm network, and recently graduated from HBS.

Ethos AI is an end-to-end Model Trust Management platform for financial services, providing a single source of truth for model validation, AI governance, and regulatory compliance. The founding team comes from DataRobot and Percy.

Lunchbox Health is a digital health software company that helps employers, employees, and health insurance brokers adopt ICHRA plans.

InScope is automating the generation of GAAP-compliant financial statements, footnotes, and audit-ready documentation. The founding team comes from our prior portfolio companies, Flexport and Vouch.

Indagari provides insights into consumer behavior based on transaction data, which answers key business questions for growth, strategy, and marketing teams at B2C companies. The founding team comes from our prior portfolio company, Second Measure.

📈 BTV Portfolio Updates

💰 Fundraising

Trébol announced their $3 million seed funding round! To learn more about why we invested, check out some thoughts from JC!

Collective announced their $50 million funding round! As Jake said, we were extremely excited by the prospect of finally getting a chance to work with Hooman and Ugur! We’ve also been able to bring Ugur into the family as a mentor at The Mint.

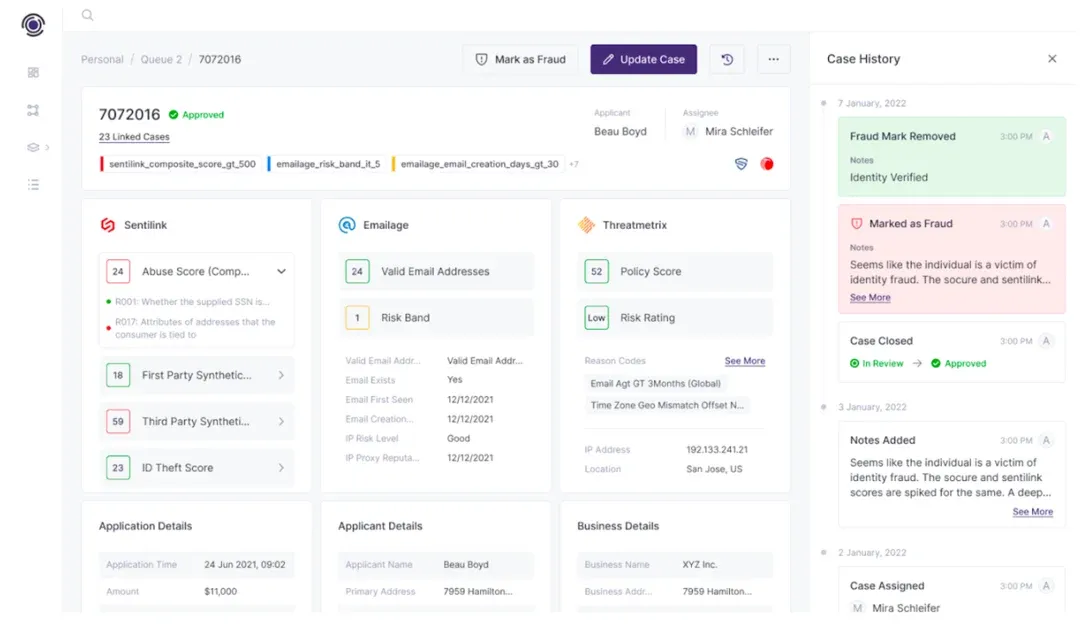

Effectiv announced their $4.5 million seed funding round! To learn more about why we invested, check out some thoughts from Nihar!

Ramp raised $300 million in a new funding round, co-led by Thrive Capital and Sands Capital at a $5.8 billion post-money valuation.

📰 In the News

Unit:

- Published a guide on how to generate 2-4x more revenue by expanding from payment acceptance to banking.

- Was featured in Business Insider’s 2023 list of "The Most Promising Tech Companies."

Nilus published a blog post on the keys to managing cash across multiple banks.

Settle raised a $145 million credit facility from Silicon Valley Bank.

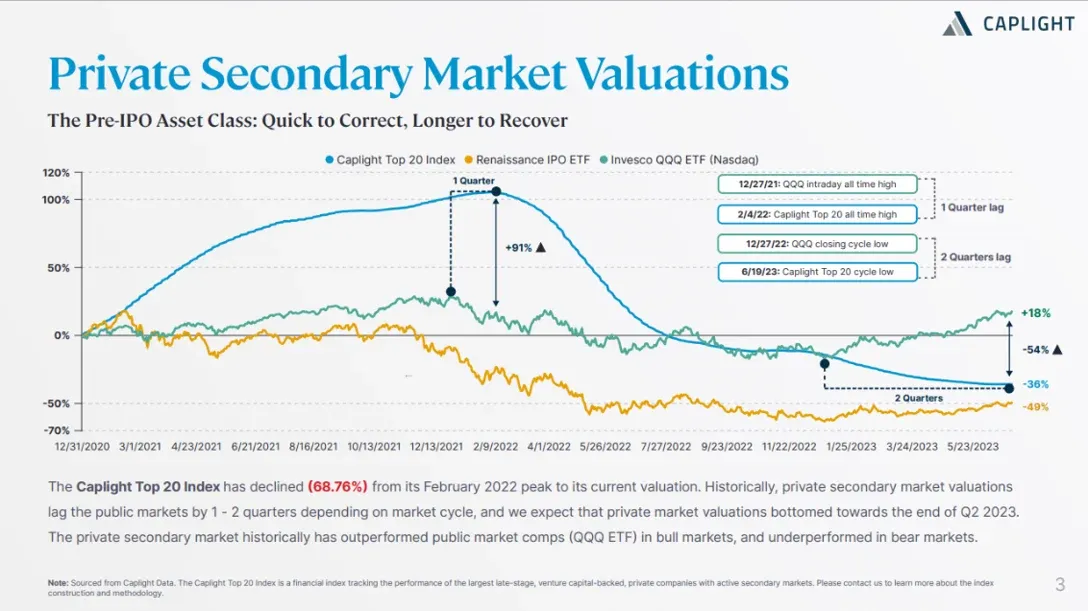

Caplight published its 1H 2020 Pre-IPO secondary market update.

AngelList announced that it is acquiring Nova, a startup that builds investor management software for private funds.

FarmRaise launched a new feature that allows farmers to track livestock, crops, and product inventories.

Pave launched a Liabilities Dashboard, which allows lenders to understand their borrowers’ ability to handle debt.

Relay launched automated savings accounts, a way for their business customers to save and earn between 1% to 3% APY.

Selfbook:

- Released a new feature, Selfbook Payment Links, which allows hotels to instantly create and share customer payment links for any hotel charge.

- Launched a partnership with Affirm and a handful of joint hotel partners, offering the value of Selfbook’s direct booking flow with Affirm’s monthly and biweekly payment options.

Ramp announced the release of Ramp Plus, which gives finance teams access to a new suite of procurement tools.

Drippi rebranded from Twali and launched the first-ever creator valuation tool,showing creators exactly what they’re worth so they can negotiate bigger partners and bigger paychecks.

Mercury launched a new feature, SAFEs by Mercury, that will enable “founders to manage the end-to-end SAFE process — from document creation and distribution to payment requests and tracking — straight from their Mercury dashboard.”

📢 BTV in the Spotlight

Podcasts and articles featuring our portfolio founders:

- Khalid (Selfbook) was on the Wharton Fintech Podcast, in an episode hosted by BTV’s very own Nihar! In the episode, Khalid discussed his journey to America, why frictionless payments are so important for hospitality, what's next for Selfbook, and what he's excited about in fintech.

- Gavin (Brick) was a featured speaker at Founders Feature by Antler Indonesia.

- Javier (Caplight) was on Bloomberg Radio, discussing Caplight’s view on secondary market trends.

- Rebecca (Divibank) was on Crossing Borders, talking about what she learned from working on digital marketing campaigns for huge brands, how she got Divibank off the ground, and how Divibank provides a better financing alternative for entrepreneurs in Brazil.

- Hooman (Collective) spoke at Collision on how AI is unleashing productivity.

- Daniel (Nilus) spoke with CTect by Calcalist about how Nilus is helping startups navigate a challenging market.

- Misha (Nova Credit) was on BNN Bloomberg, talking about Nova’s Canadian expansion.

- Danielle (Nilus) was on Code Story, talking about her philosophy for building a good MVP, why it was key for her to adopt a scalability mindset (what that actually means), and why it’s so important to have a team that shares one's passion and vision.

Podcasts and articles featuring Team BTV — AKA Sheel. In the last few months, he was:

- Featured in Business Insider’s list of the 100 "Best Early-Stage Investors"; he was ranked the #15 seed investor this year!

- Featured in Meridian by Mercury, talking about supporting immigrant entrepreneurs along with how his parents, who immigrated in 1974, shaped his love for supporting fintech around the world;

- On TwentyMinuteVC (again), this time talking about why fund sizes should be smaller, whether or not founders should have their own funds, the state of emerging markets investing, whether or not fintech investing is dead, and who will be the winners and losers in VC in the next 10 years;

- On the Build in Public Podcast, talking about the must-have qualities for you to become a successful entrepreneur;

- On the Tank Talk Podcast, talking about what he learned as a founder and how he’s grown as an investor;

- On Breaking Banks, talking about his first foray into the fintech world with a non-profit and why he dedicated his career to making the consumer experience better;

- On the Business Podcast by Roohi, talking about immigrant mentality and bias for action, The Mint accelerator, The Pitch Show, and the impact of Sheel's parents on his life;

- On Legendary Leader, talking about the process of going from a fintech entrepreneur to a top venture capitalist.

🤙 Community

Community hangs started strong in May as a16z’s second annual TechWeek blasted off in San Francisco. We joined in on the fun by taking over our favorite taco spot to host a fintech fireside with two of our local founders.

Then, we decided to build a bar in our office (because why not) and co-host a bar crawl with NFX. The theme? Time machine: early 2000s at BTV -> 1970s at NFX. The nostalgia is still palpable.

June kept the vibes high. A16z’s TechWeek hit LA, and we were there hosting a fintech fireside + breathwork session — because we can’t resist any opportunity to gather community for some self-care practice. Then, we balanced it out by grabbing some pints with our London founders on the way home from Money2020 Amsterdam.

In July, our team had what we’re calling an "onsite-offsite." We all gathered in San Francisco for a weekend of fun followed by some good ol’ fashioned co-working time. We layered up for a sunset sail, had a sweet pool party at Casa del Jake, and put our noses to the grindstone IRL!

To wrap things up, Jake flew to São Paulo in August to spend some time with our portfolio and the broader Brazilian fintech network!

💪 Talent

The talent market continues to be in flux with industry-wide headcount reductions continuing at companies big and small.

Our efforts have been focused on meeting and engaging fintech talent who are excited to keep working and building in fintech, with specific interest in candidates aligned to product development (product managers and engineers).

To that end, we've added over 150 candidates to our talent network so far this year. And we continue to make introductions to help support the growth and hiring needs of our portfolio companies.

Coming soon: a searchable database of this talent for founders to access whenever the time is right to add key folks to their teams.

🗓️ Coming Up - Let's Hang!

Here’s where you’ll find Team BTV over the next few months:

- Now-October 31, San Francisco: Since The Mint is officially off to the races, most of our team will be working alongside the batch in San Francisco for the next 3 months! We’re steadily adding events and activities with the batch + our Bay Area network, so keep an eye out for an invite!

- September 25-30, Mexico: Most of Team BTV is heading to Mexico because Sheel’s getting married! (Yes, he technically already did that in Taco Bell’s Metaverse, but why only have 1 wedding?)

- October 12, San Francisco: October 12 is a big day for us. Not only is it our Annual LP Meeting, but we will also unveil our accelerator's first cohort! RSVP to Demo Day here.

- October 22-25, Las Vegas: Most of Team BTV will make it out to Vegas for Money 20/20. We'll be hosting some fun hangs as we are wont to do, so keep an eye out for invites!

Made it this far? We appreciate you. Feel free to hit reply and tell us what you want from this newsletter so we can be better tomorrow (and next quarter).

Until next time,

Team BTV