4Q22 Newsletter

👋 Hello, It's BTV

We hope you enjoyed some time off over the holidays and have had a great start to 2023.

Let’s recap how the BTV team closed out 2022.

First, our latest update on that front: Nihar joined the team full-time as the first recipient of the Sheel fellowship!

✨ New to the Portfolio

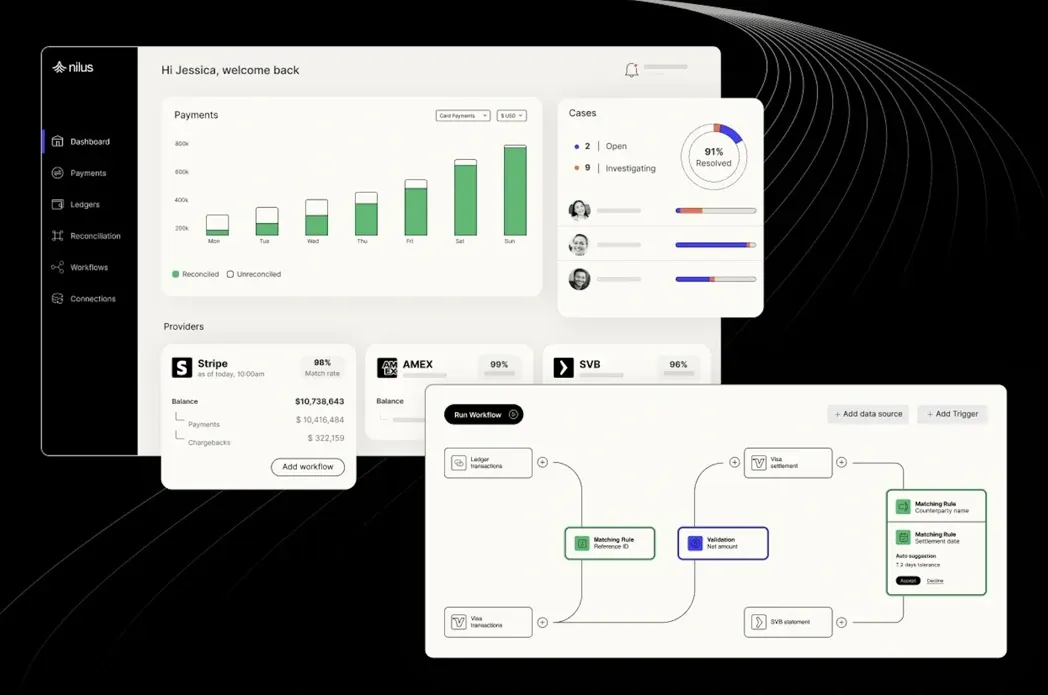

Nilus

announced their $8.5 million seed funding round. To learn more about why we invested, check out some thoughts from Jenny!

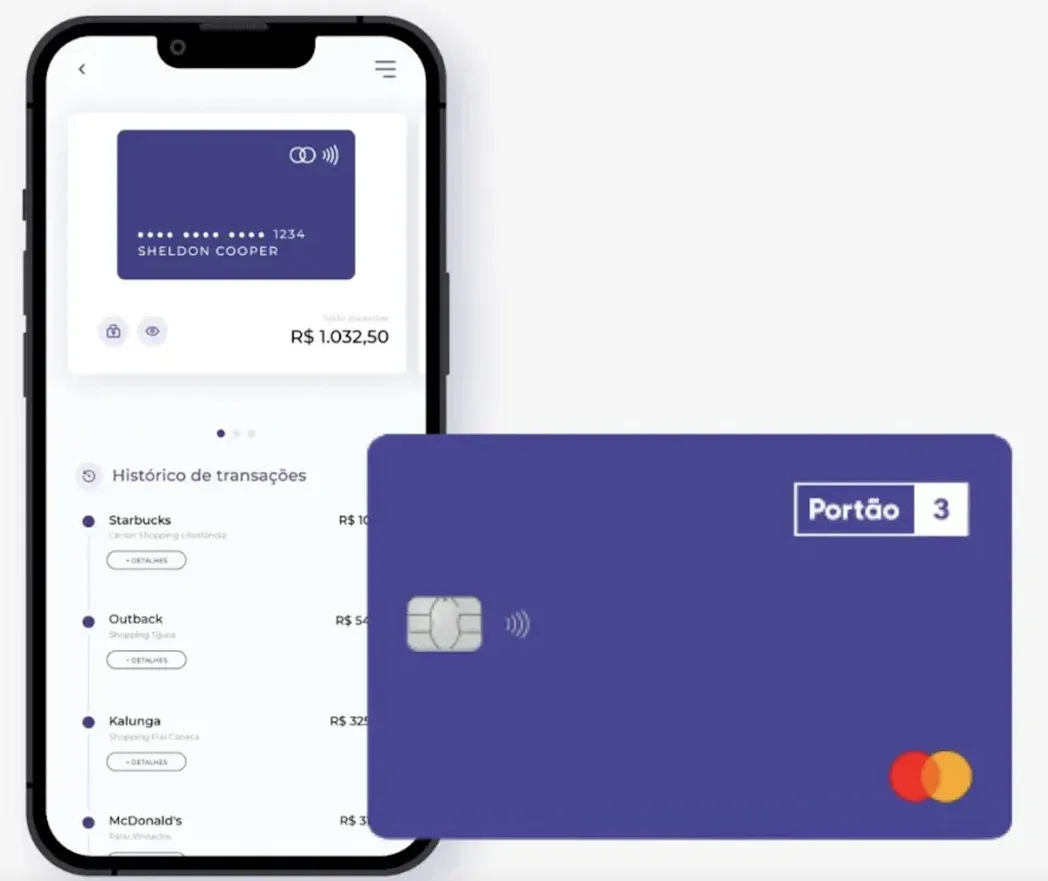

Portão 3

announced their $3.7 million seed funding round. To learn more about why we invested, check out some thoughts from Jake!

🚀 Portfolio Updates

Indiagold:

Extended its Series A funding round with an additional $10 million, bringing the total amount raised in the round to $22 million.

Caplight:

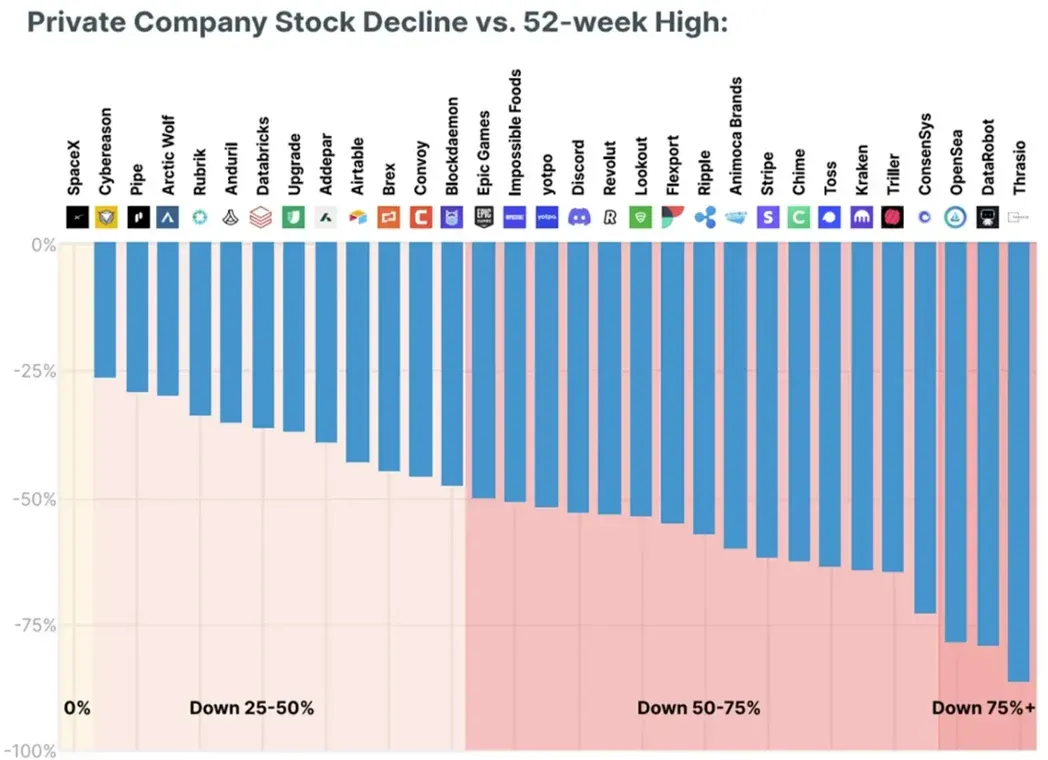

- Was featured in an article by the Washington Post. Regarding the FTX collapse that has dominated headlines and rippled across the tech community late last year, the article highlights the historic inability of investors to short private company shares. The article specifically mentions that Caplight technology allows "professional investors to make bullish or bearish bets on unlisted startups via call and put options," going as far to say that the financial instrument they are offering can help in "holding unicorns to account."

- Published an article, "2023: Year of the Down Round?" and its 2022 Year End Wrap Preview featuring insights from the Caplight Data product. We recommend following Caplight’s content closely; their price discovery tools provide near real-time insight into investor appetite for private companies.

- Launched Caplight Data, a platform for monitoring private company valuations to improve transparency in the private market. We think it’s a product that's perfect for the volatility and uncertainty of today's markets — when VCs, hedge funds, family offices, and other asset managers could use all the information they can get! Here's a screenshot teaser:

Amitruck:

Was featured in a Google for Startups story, explaining how the company helps the East African shipping market by cutting costs, red tape, and go-betweens, and by building trust and transparency.

Chipper Cash:

Announced its intent to acquire Zambian fintech, Zoona, which offers products such as money transfers, electronic voucher payments, and agent payment.

Paytrix:

Announced that it appointed David Sola as Chief Financial Officer. David has previously served as Managing Director at UBS, Softbank Europe, and Houlihan Lokey.

Tome:

Emerged from stealth and publicly invited companies to join their early-access product, which focuses on contracts and agreements related to early-stage VC deals, saving customers and investors tons of time on legal bills. They’re looking for investors to trial the product and provide feedback, so hit us up if you’re interested.

Selfbook:

- Announced a strategic investment from AmEx Ventures.

- Partnered with Guestbook to integrate cash rewards into their hotel booking and checkout flow.

Capbase:

Was acquired by remote payroll startup, Deel, expanding their suite of tools for global companies.

Unit:

- Published "The ultimate guide to banking-as-a-service."

- Partnered with Financial Solutions Lab to be a resource for their alumni network of startups working to improve financial access for underserved Americans.

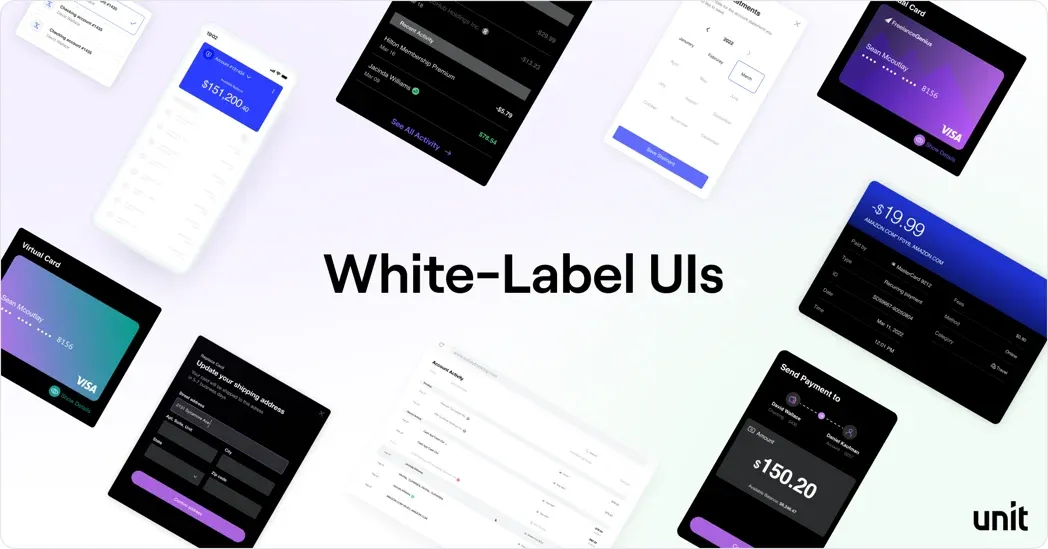

- Launched White-Label User Interfaces (UIs), a suite of customizable components and apps that will make it even easier and faster for companies to build and launch an embedded banking and lending experience.

Monnai:

Announced that in its first full year of operations, they “demonstrated strong product market fit, customer traction, and growth,” quickly emerging as a leading solution for any fintech company that needs access to a global platform that helps them onboard new customers across the following areas: fraud, credit decisioning, and collections.

NovaCredit:

Received approval from the Financial Conduct Authority to begin operations in the UK.

Mendel:

Acquired Te Facturo, which provides technology to recover digital tax receipts. The technology will allow Mendel to validate invoices against the Tax Administration Service (SAT) and verify expenses in accordance with the recent changes enforced by the SAT.

📰 BTV In the News

Podcasts and articles featuring our portfolio founders:

- Pierre (Monnai) was on Qorus Global, talking about how Monnai leverages AI to provide infrastructure that connects disparate data sources though a single API — so fintechs can focus on growth.

- Pierre was also on Authority Magazine, talking about the 5 things he wishes someone told him before he became a founder.

- And Pierre wrote a piece for FinTech Buzz, talking about how companies need to unlock the global potential by tapping into a global mentality, connecting the world, and leveraging global flows of money, services, people, and data.

- Hunter (LogRock) was on Standing Out, sharing his thoughts on sales, marketing, and leadership.

- Emma (Offsyte) was on Her Forward, sharing her thoughts on the importance of building a support system as a female entrepreneur.

- Itai (Unit) was on PYMNTS, talking about how APIs and platforms can help firms launch banking products in weeks.

- Bianca (Portão 3) wrote a piece for startups.com.br, talking about how platforms like Portão 3 are supporting the entire process of managing expenses and payments in the way that CFOs need.

- Bianca also wrote a piece for Economia SP, sharing her thoughts regarding the strategy that startups need to hire with given the current market.

- Hooman (Collective) was on Gusto’s SMB Tech Innovators Podcast, talking about Collective’s mission to support the fastest-growing class of entrepreneurs in the world: businesses of one.

Our BTV team also spent some time on the podcast and panelist circuits:

- Jake and Sheel were on Venture Unlocked with our friend and LP, Samir Kaji, talking about investing in fintech, fund construction, and fundraising lessons.

- Sheel was on PMF, talking about why defining PMF is like defining love(!), how maniacal focus on customer success + speed of iteration helps in achieving PMF, and why long-term success involves finding multiple PMFs (in different segments, as some segments may not be large enough to sustain a massive business).

- Sheel was on Carta’s 2022 Annual Equity Summit, talking about new fund structures and strategies and how to differentiate in a crowded market.

- Sheel was on Random Walk, talking about what makes a good VC, mistakes venture capitalists make, what a fintech investor should care about, and who would win on the show Survivor: venture capitalists or hedge funders?

- Aaron, our resident Entrepreneur in Retirement, was on the latest edition of Framing Fintech, Alloy’s blog series, talking about how new credit card startups should approach launching a credit product.

- Jenny was on This Week in Fintech’s podcast, Beyond Two Percent, talking about the ins-and-outs of angel investing, how she got started, what she looks for in an investment, and what she's learned along the way.

🤙 Community

We’re continuing to build our founder community, increasing connections with each other (and with BTV), and fostering engagement.

Part of this is regularly hosting BTV founder events, like founder networking dinners in specific geographies. If you're a BTV founder, let us know which cities we should host these in!

Speaking of community, we co-sponsored a fintech coffee meetup in NYC last month. It was a blast!

💪 Talent

In December, we launched "Be Better Tomorrow," our founder-focused webinars with topic-specific experts, held quarterly.

We kicked it off with an illuminating session on "Compensation for Early-Stage Startups." Tentative upcoming topics include: (i) building brand at an early stage, (ii) user research/product development, and (iii) founder-led sales. Know of an expert who'd like to help our founders? Hit reply, we'd love to be connected.

We're continuing to establish the BTV portfolio as a home for fintech talent. To that end, we plan on hosting in-person networking and meet-ups in key geographies. Interested? Get on the invite lists here!

📚 Good Reads

We recommend taking a look at:

- AVC’s post: "What Will Happen in 2023," which focuses on the macro environment for tech, startups, web3, and climate.

- Alex Johnson’s post: "Choose Your Own (Card Issuing) Adventure," which we think is a great primer on the payment card space.

- Bain Capital’s post: "The Fintech Formula: A Data-Driven Blueprint for Creating Enduring Value," which reflects on how and why publicly-traded fintech companies fared worse than their non-fintech counterparts.

🗓️ Coming Up - Let's Hang!

Where you'll find Team BTV over the next few months:

- Week of February 20: A good portion of our team will be in San Francisco for Sheel’s Taco Bell Metaverse Wedding. …yep, you read that right.

- February 27-March 3: Jake will be in LA for the Upfront Summit, and he and Lauren will be hosting a happy hour for our fintech friends on March 3!

- March 9-10: Sheel might be in Park City, Utah.

- March 20: Sheel will be speaking in Vegas at the Fintech Meetup.

- March 23-26: The BTV team is heading to Austin — expect lots of content! We’ll be throwing a happy hour on March 23.

- Week of April 3: Jake might be in CDMX.

- Week of April 17 and/or April 24: Sheel will be in NYC.

Made it this far? We appreciate you. Feel free to hit reply and tell us what you want from this newsletter so we can be better tomorrow (and next quarter).

Until next time,

Team BTV