Investing in Global Trade

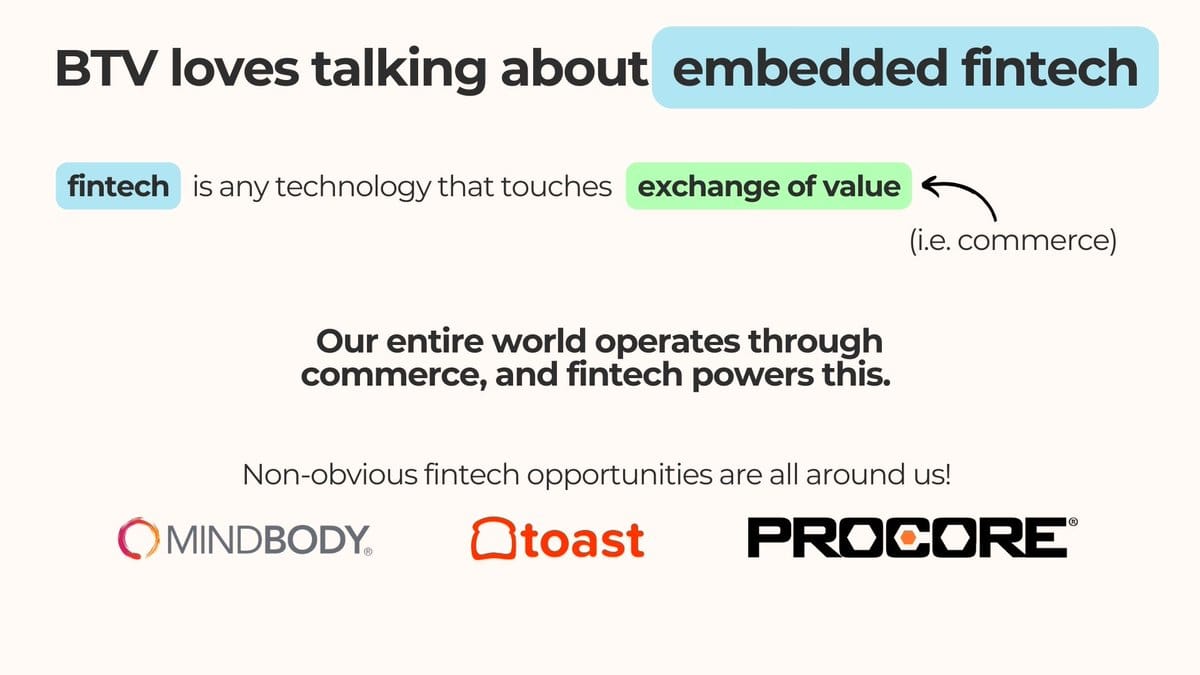

Most know BTV as a fintech fund. So how does global trade fit in?

For us, fintech is any technology that touches (catalyzes, protects, underwrites...) exchange of value.

Exchange of value = commerce, which is facilitated by global trade!

At @btv_vc, we're excited about companies building for global trade.

Opportunities in this space take various forms from b2b payments (i.e. workflows), to trade financing, cross-border payments infra and b2b marketplaces.

Publishing some thoughts recently shared with our LPs.

Most know @btv_vc as a fintech fund. So how does global trade fit in?

For us, fintech is any technology that touches (catalyzes, protects, underwrites...) exchange of value.

Exchange of value = commerce, which is facilitated by global trade!

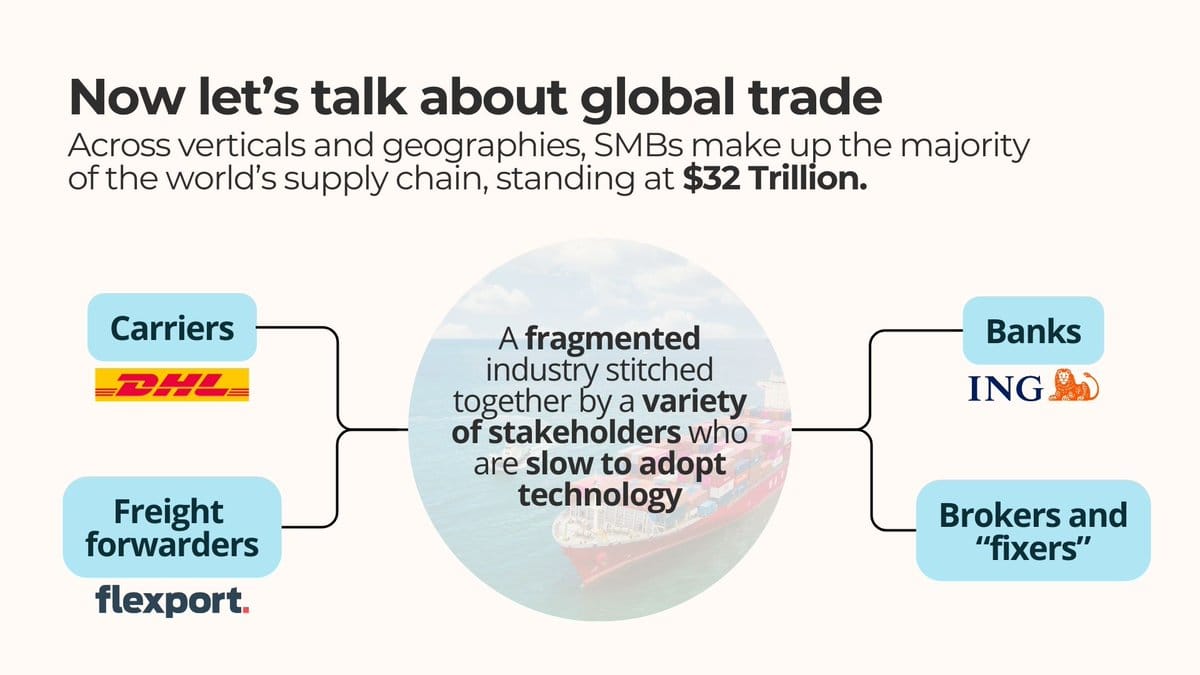

A VC cliche is to invest in fragmented markets with massive TAM. Global trade fits this cliche pretty well.

But this is a lazy generalization, so let's dig deeper.

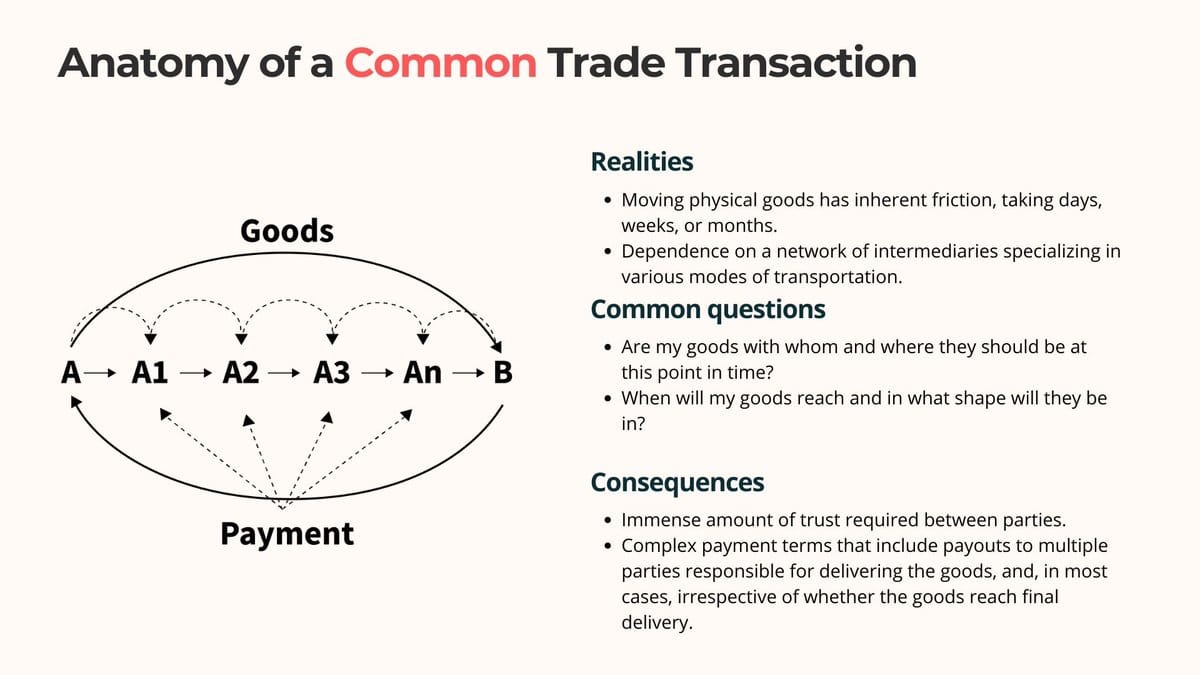

Keeping it simple, a typical trade transaction deals with friction in movement of goods & informational asymmetry causing lack of trust, both of which lead to setting up complex payment terms.

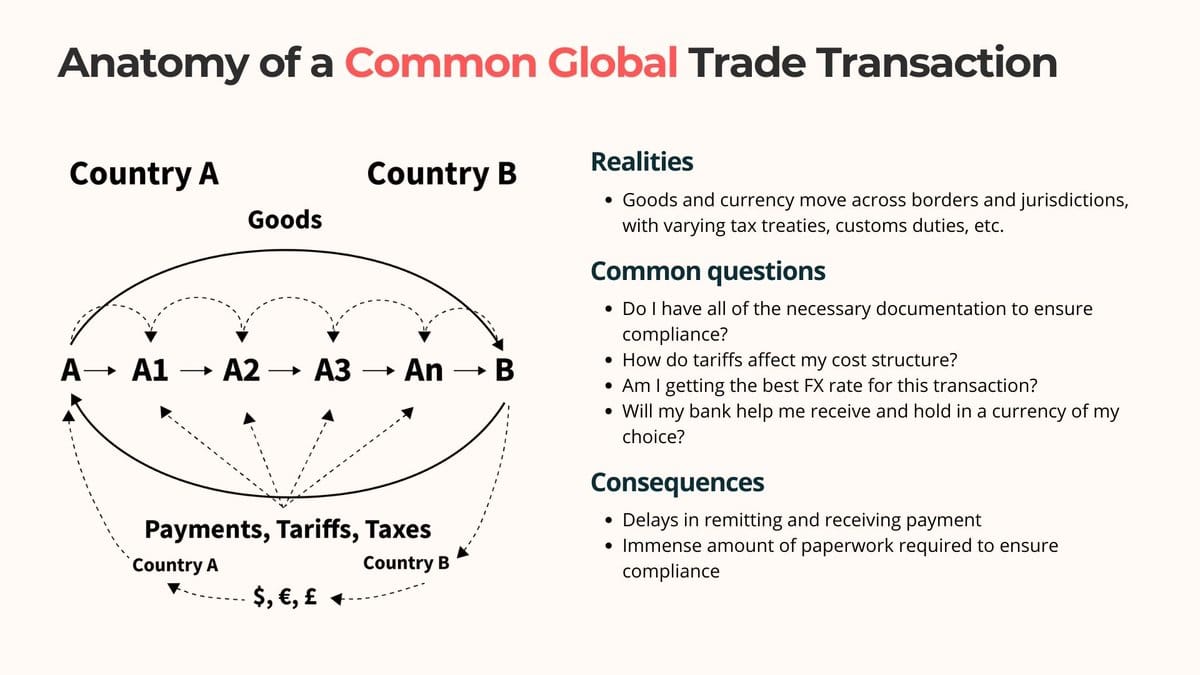

And in this interconnected world that we live in, a significant portion of trade is cross border. This affects compliance, costs, and financial operations (like FX + treasury).

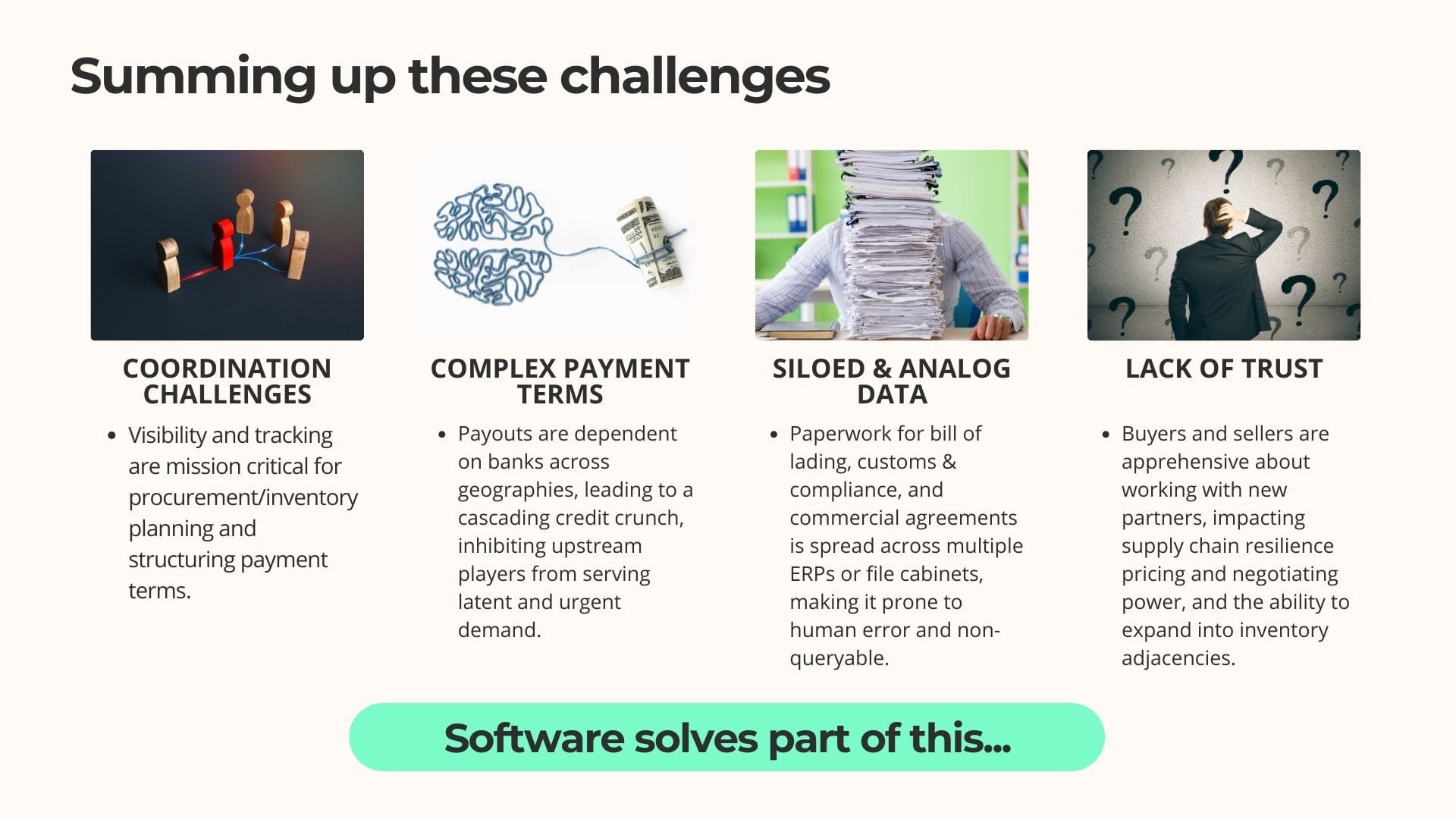

As a result, stakeholders across these supply chains are challenged with:

- Coordination & Information alignment

- Compliance

- (Lack of) trade financing

- (Lack of) contextual + alternative underwriting

- Financial operations & planning

- Procurement & vendor/client management

In our mind, fintech's opportunity = Saas + banking/payment infrastructure + capital, to offer products that:

- Facilitate & ensure trust across vested parties

- Streamline workflows across compliance, bizops, vendor/client management...

- Serve as a financial command center

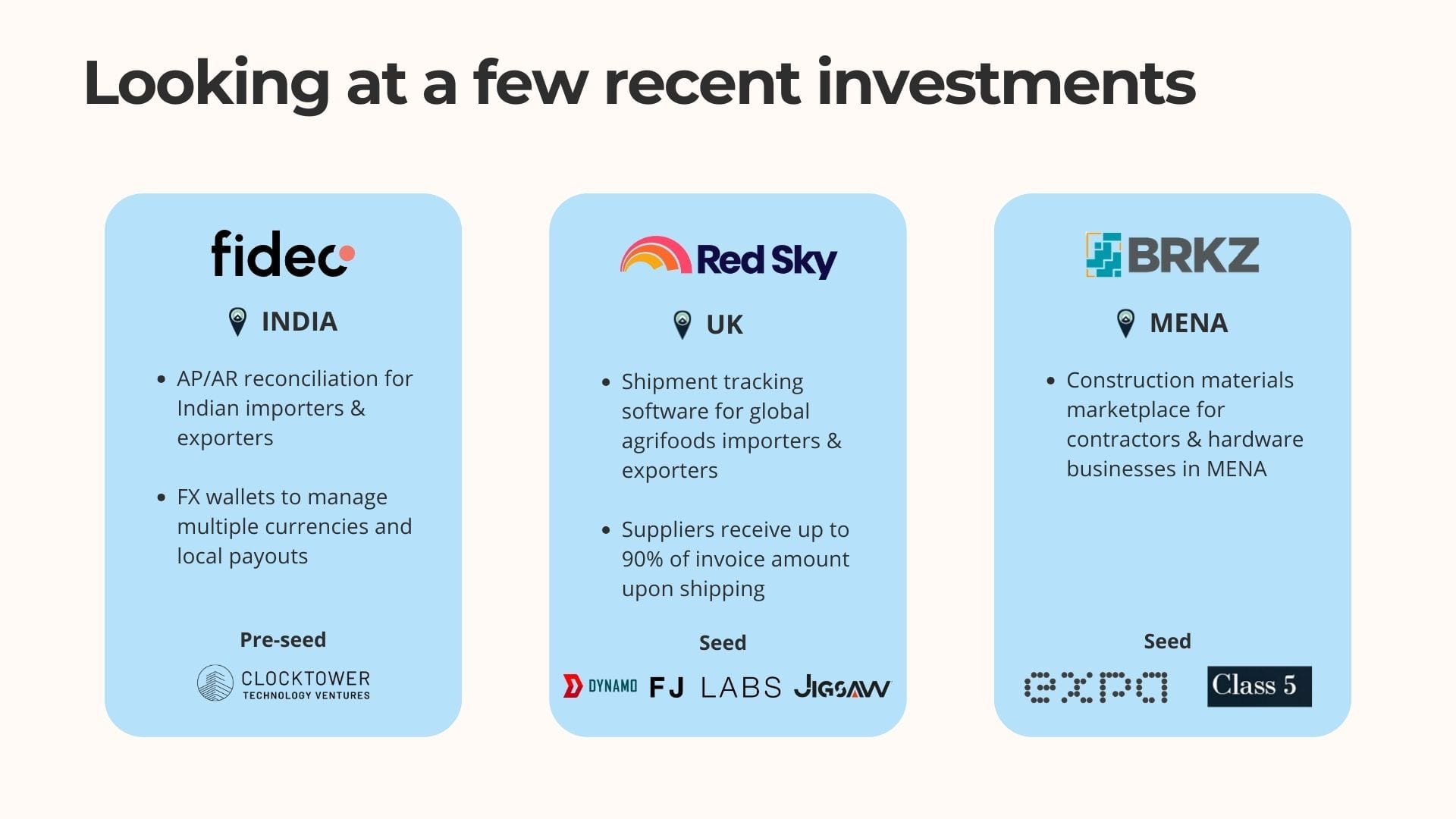

Here are some of our more recent investments in the space:

- Fideo

- Red Sky

- BRKZ

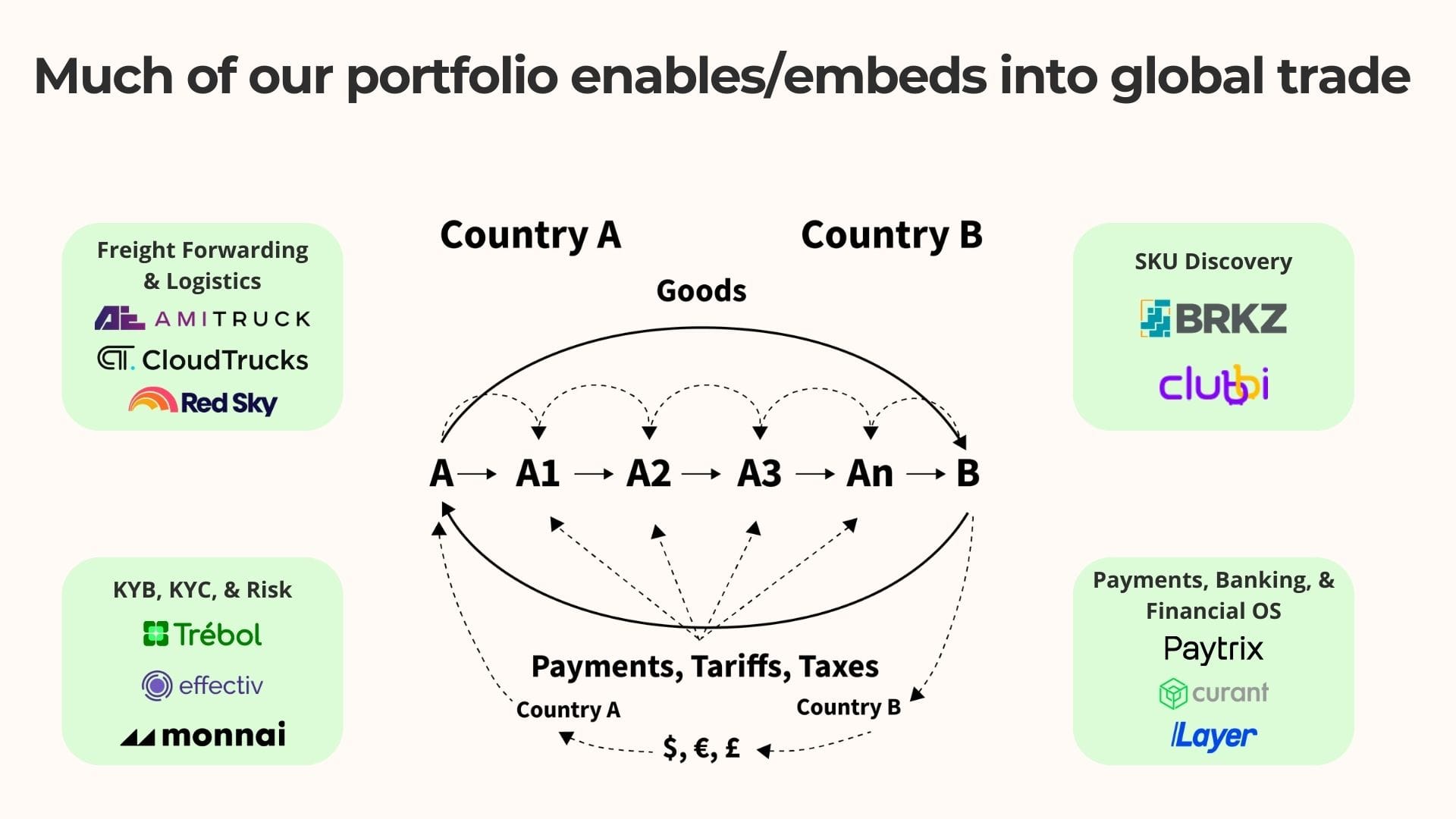

But much of our portfolio directly/indirectly embeds into global trade too!

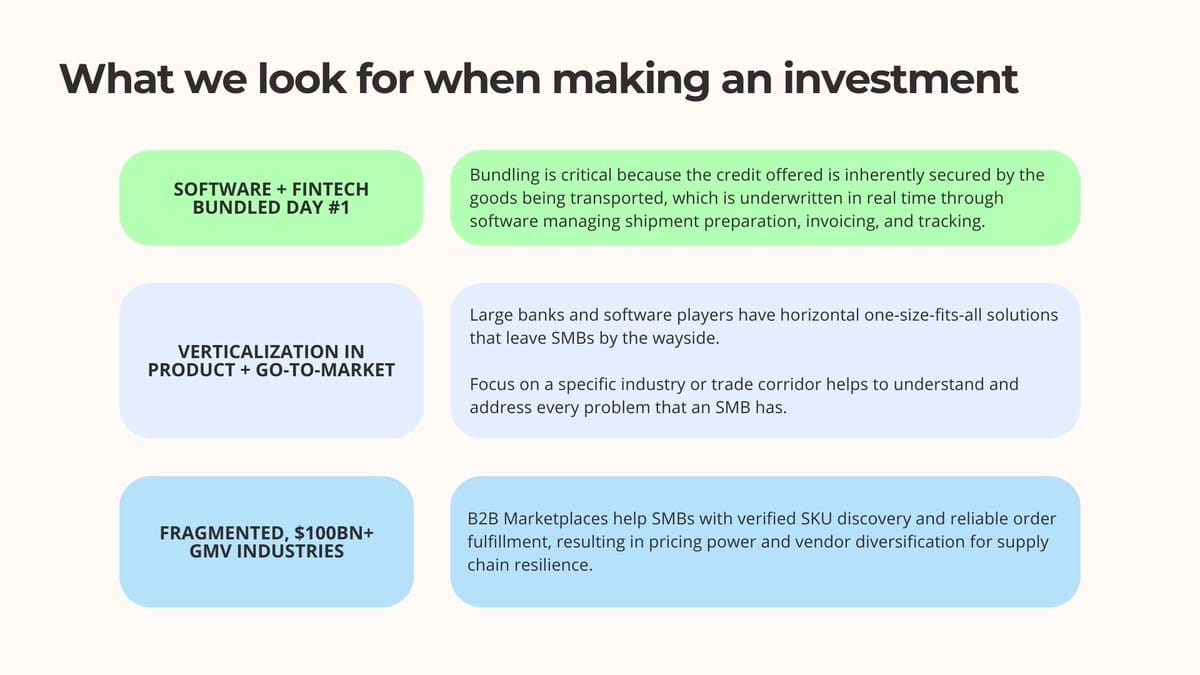

If you're a startup building in the space or a founder looking to start up, here's (some of) what we look for:

- Software + fintech bundled from day 1

- Industry verticalization

- Fragmented ~$100Bn+ GMV industries

Want to tell us more about what you're building? Or know someone you think we should meet? DM or email me (nihar@btv.vc)!