We're Launching an Accelerator!

Fintech founders have unique needs; we're building the best accelerator to serve them.

We're launching an accelerator at Better Tomorrow Ventures, called The Mint!

Fintech founders have unique needs; we're building the best accelerator to serve them. Our first cohort starts in SF on Aug 1.

Jake Gibson and I did this before, with 500 Fintech, and were fortunate to work with a bunch of amazing companies at inception - Albert, Chipper Cash, Ethic, Indio, Kin, and many others.

Some of those founders have asked us what accelerator they could recommend to their friends - a supportive accelerator built for the unique needs of fintech startups, and there wasn't one... So, we decided to build it.

Check us out at themint.vc and please send great founders our way!

The Mint, started by Better Tomorrow Ventures, wants to be the accelerator fintech needs

Better Tomorrow Ventures’ Sheel Mohnot landed some of his biggest wins before he ever started a venture firm. The investor previously worked as a partner at 500, previously known as 500 Startups, where he raised and ran a dedicated fintech fund as well as helped build an accelerator.

There he met his eventual founding partner at BTV – Jake Gibson – and backed a cadre of fintech startups, including Chipper and Albert, each at $2.5 million valuations. Today, Chipper is valued at over $1 billion, and Albert has raised over $175 million.

And while the firm has certainly cashed in on that early track record – raising a $225 million second fund last year – the duo behind it thinks it’s time to launch a nod toward their roots. Better Tomorrow Ventures tells TechCrunch that it is launching a fintech accelerator, this time under its own roof, called The Mint.

The Mint will be a three-month accelerator, based out of San Francisco, that cuts $500,000 checks in exchange for 10% equity in between six to ten startups. The initial cohort, which starts this upcoming August, already accepted one company, and sent a second acceptance letter out today.

“It’s something we’ve done successfully before. Our returns were crazy, crazy good from that initial fintech cohort, so I think if we can get anywhere near that again, our LPs will be happy,” Mohnot said.

The accelerator offers some standard support: a speaker series that includes founders from Mercury, Flexport and NerdWallet, office hours with experts, wellness resources, hiring support and desk space. Unlike some Zoom accelerator programs, The Mint is long San Francisco: two team members are moving to the city to help with logistics, and Better Tomorrow is leasing a new office space, outside of its Mission HQ, dedicated to the accelerator.

Better Tomorrow seems to be stepping in where it believes Y Combinator is lacking. “YC is built for scale. The advice is a lot like one size fits all,” Mohnot said. “We felt like with fintech, there are so many things that are unique about building that it makes sense to have something distinct.”

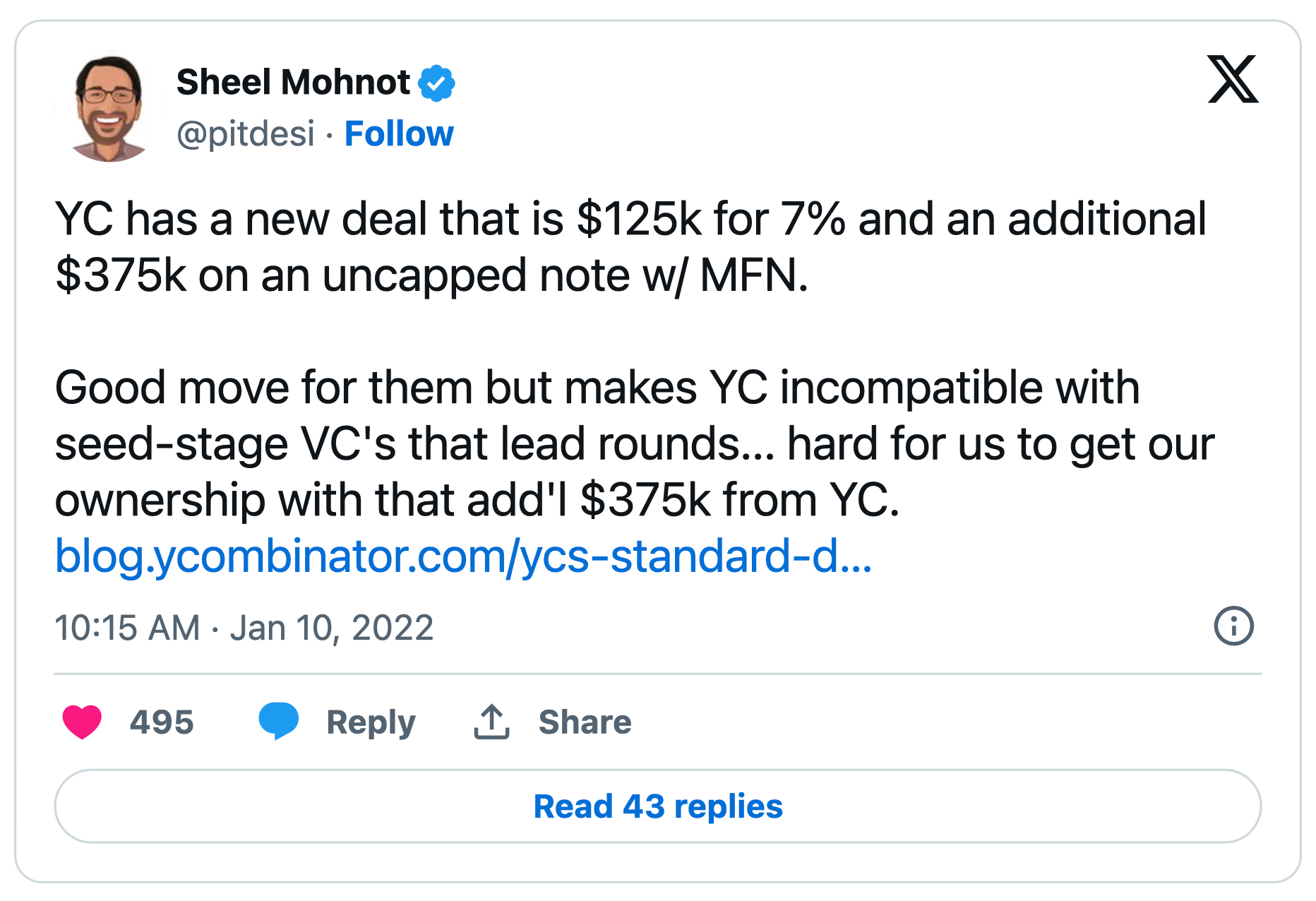

Among some seed stage investors, YC’s new standard deal has been met with varying degrees of weariness. Last year, YC announced that it would still offer its original deal – a $125,000 check in exchange for 7/% equity – as well as a $375,000 check at an uncapped SAFE note with a most favored nation (MFN) clause. The latter has stirred up some controversy: an MFN means that YC will get to invest $375,000 at the same terms as the investor who has the best terms in the next round. Now, YC companies are less incentivized to raise a small amount of money from angels, and more incentivized to optimize for higher valuations after Demo Day, so dilution is limited when accepting that $375,000 check.

“We think the MFN clause [that YC currently offers] can do companies a disservice. Because they end up almost having to raise at a very high valuation…you’re seeing that bite them in the ass a little bit. Because as if they don’t hit the metrics, the next round is even more challenging,” Mohnot said. While BTV’s 10% ownership is higher than other VC-spun out programs – take NextView’s $200,000 in exchange for 8% stake for an example – it’s less than what BTV usually targets for first checks, which is between 15% to 20% ownership.

Mohnot says that BTV will continue investing outside of the accelerator, but the big focus for the rest of the year in terms of net new investments will be within the program.

“I think there’s a TechCrunch article right now about fintech” pessimism, Mohnot said. “We are still really excited about the future of fintech and we liked fintech before it was cool.. At a fundamental level, financial services are 20% of GDP, and they are inherently digital, so the numbers make sense.”