Why We Invested in Portão 3

Excited to announce our investment in Portão 3 (YC S21)!

Cash flow management tools are known to provide value to businesses of all sizes, helping regulate their financial health and cash position.

As we evaluated the opportunity to invest in Portão 3, we found that enterprise companies in Brazil have access to corporate cards, but they rarely utilize the products, due to concerns around fraud, reconciliation, and decentralization of data.

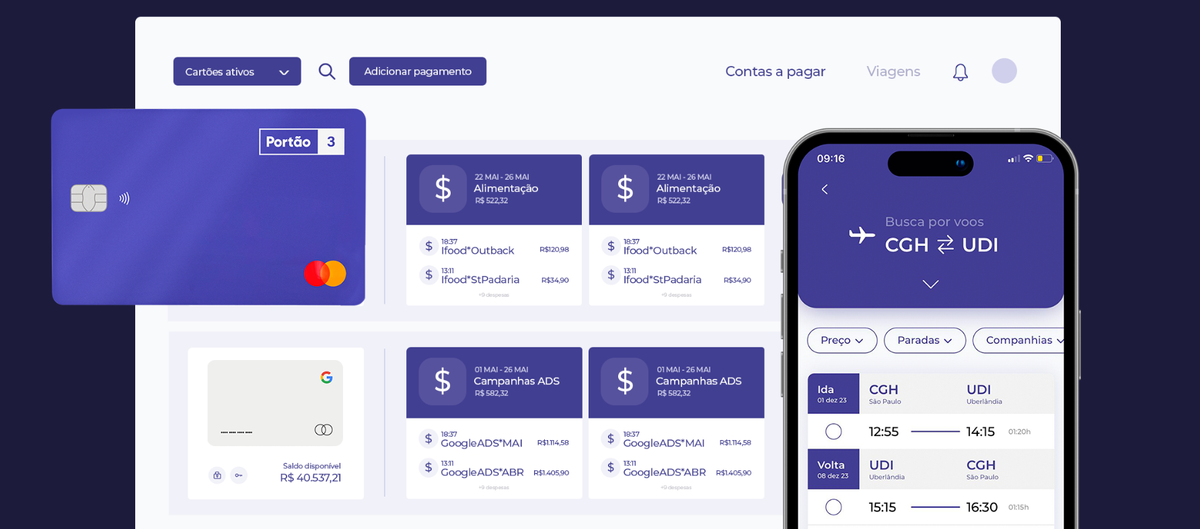

Portão 3 is solving this problem for large enterprise companies by offering software that standardizes transaction data, verifies spend on cards to detect fraud, and dramatically reduces expense reporting times.

Given that card issuing itself has become largely commoditized, Portão 3 has focused their efforts on building a financial management platform that provides controls and fraud detection to CFOs. By integrating into the various Brazilian government invoice databases and building technology to normalize and standardize that data, Portão 3 can verify any spend on the cards and ensure there are no violations of company expense policy.

Our investment in Portão 3 is the latest within a broader thesis; we have also invested in Ramp in the US and Mendel in Mexico. We are very familiar with companies that provide software beyond the cards for businesses — it’s a model that we appreciate and see a ton of value in.

Portão 3 is already working with over 600 clients and is growing rapidly! If you are an enterprise company in the consumer goods, technology, financial services, health and fleet management sector, get in touch. And the team is hiring!

Great to partner with the folks at Fin Capital and others.