The Lost Art of “F*ck Around and Find Out”

In its first year in 2009, NerdWallet made $75. The second year, that rose to about $60,000. In the first nine months of 2023, the company generated $465.7 million in revenue.

That exponential rise in fortunes was a direct result of those first lean years, when my co-founder Tim Chen and I lived on Subway sandwiches. We couldn’t afford to hire until 2012, almost three years after founding NerdWallet. We didn’t take outside funding until 2015, when we raised $64 million in our Series A.

By then, NerdWallet already had a 200-employee workforce, built on the back of profits from those lean early-year experiments that paid off. Capital wasn’t being used to determine proof of concept, but to scale a business that we already knew had a broad market fit. As noted in the first article in our series, the greatest challenge I see for the current class of aspiring entrepreneurs is dependence on the recent era of easy funding, which fell off a cliff once interest rates began to rise in early 2022.

While bootstrapping like this won’t be for every company and doesn’t work for every business model, I do believe it’s possible to do a lot more with a lot less than is typically assumed. This is why we started The Mint pre-seed program at Better Tomorrow Ventures (BTV), to help founders raise just enough money to get started and hyper-focus on what matters, with all the resources they need to run those early experiments.

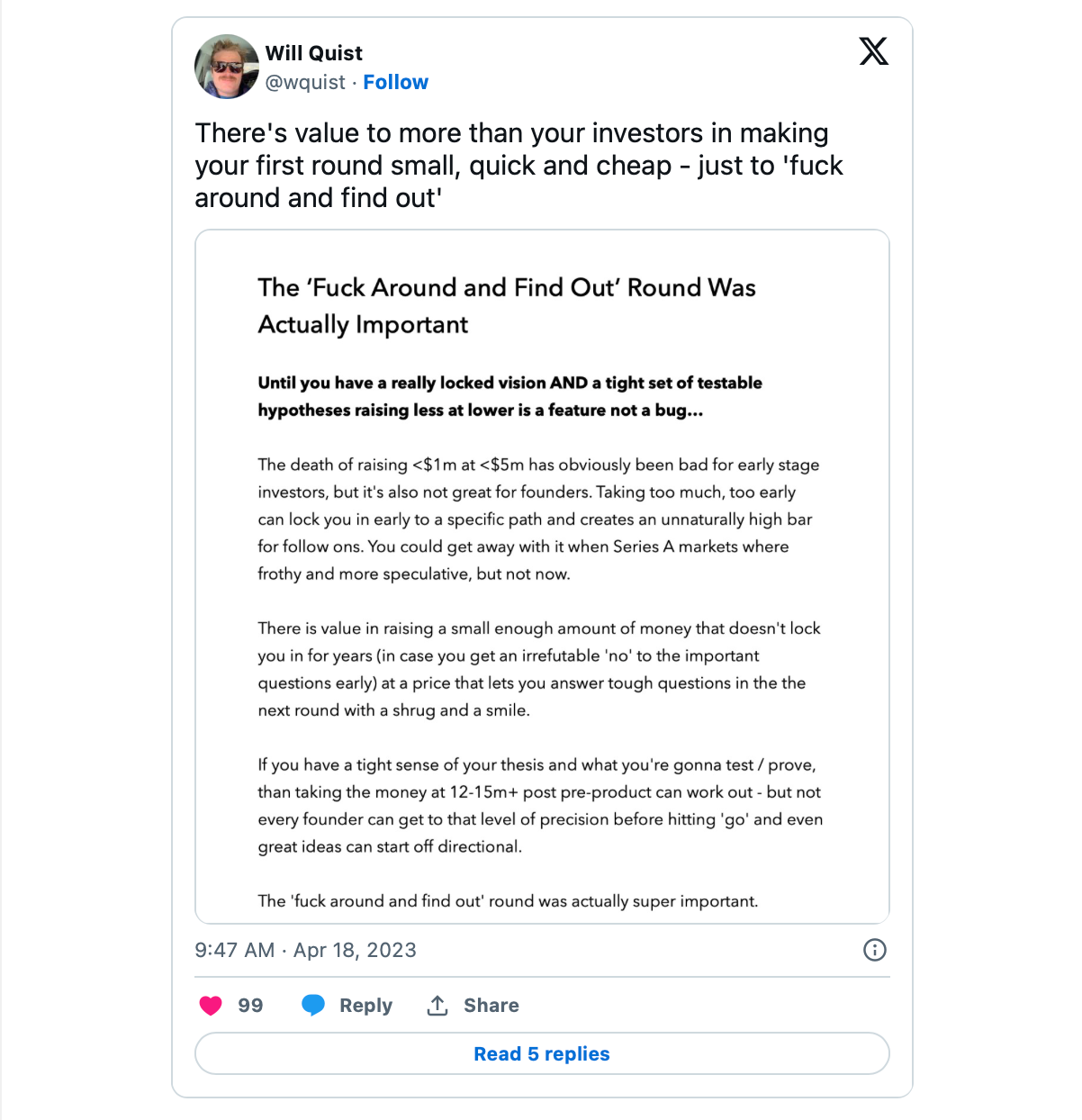

We want to bring back what our friend, Will Quist at Slow, calls the “f*ck around and find out” round.

Eating what you kill

Some of the greatest losses for entrepreneurs during the recent era of easy funding were the passion, healthy paranoia, and obsession required when your business lives or dies by your own effort. If you don’t build and ship, you don’t eat. That has a deeply clarifying impact on how to prioritize your efforts, when to double down on an idea, and when to cut bait.

When you can feel the clock ticking, how you spend every minute of your day and how many minutes each day you dedicate to the cause become existential questions. Everything you do has to have an impact. You have no choice but to figure out what the right inputs are, and hyperfocus on driving them forward, or you die.

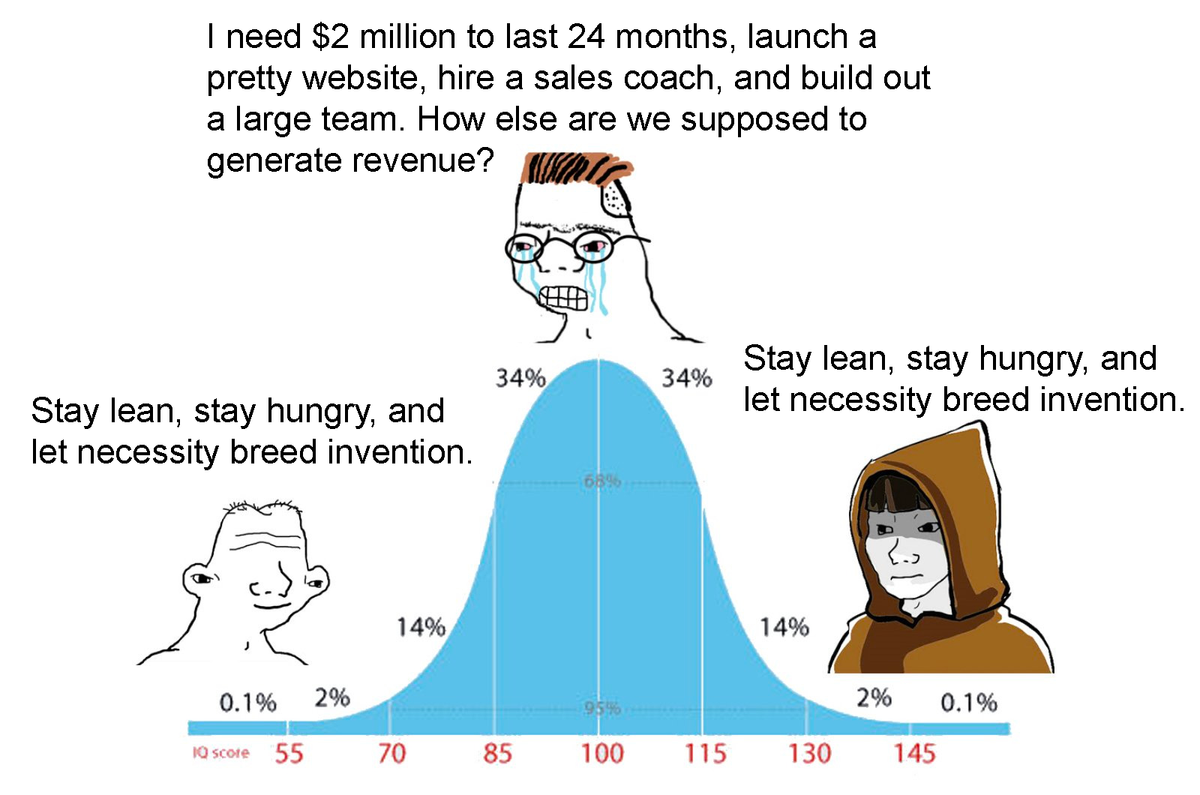

There’s no time for “playing business.” When money was raining from the sky, I saw a lot of early-stage founders waste cycles on things like refactoring code bases, paying for coaches, hiring experienced salespeople, changing their company name, or rebranding. But guess what? If no one’s ever heard of you, no one cares what your name is.

If you don’t have any revenue, I promise you that moving around some pixels or changing some colors isn’t going to change that. Your codebase doesn’t matter when no one is using your product. You don’t need a coach, you need a therapist. And you don’t need salespeople if no one wants to buy your product anyway.

When you're operating in conditions of scarcity – you don't have time, you don't have bodies, you can’t just throw money at the problem – you have to get really creative and really resourceful. This is what ultimately led to the SEO and content marketing strategies that NerdWallet is famous for. We couldn’t afford to pay for advertising or do any marketing, but we realized that Google could be the largest free billboard in the world if we did it right.

Tim and I started as two randos in a windowless shoebox who just had to outsmart an entire industry of experienced SEO consultants and people who’d spent their entire careers shilling financial products online.

Speed of iteration is key

The “eat what you kill” ethos also does some of the hard work to correct what I see as the central problem created for entrepreneurs during the easy credit era: Speed of execution. The greatest single metric that I’ve found to determine which startups will fail and which will become household names is the speed at which they ship. And when you have no investor cash reserves to fall back on, fast is the only speed you know.

Most people think of runway and burn in terms of time. How long will this money last? But really, runway should be thought of as how many experiments you can ship, and burn should be thought of as the cost of how much learning you can do. So the cheaper and faster you can produce, the farther you can go. And unlike the ticking of the clock, your own velocity is within your control.

One of the things that we built into the organization early on that paid a lot of dividends down the road was a culture of experimentation: Build shit, test it out, and try to get marketing around it. We mentally had this philosophy of rapid experimentation and doubling down on things that were working well. And if it failed, we scrapped it and moved on.

We built all kinds of things that seemed totally unrelated to the core business. We had things like a gas cost tool – because at the time, gas prices were at a high – which Tim and I built ourselves from scratch. We spent a lot of time on it, tried to get marketing and links to it, but it just didn’t work. Out it went.

Early on, we had a Travel vertical, which we put a ton of resources into. We got a bunch of good press around it – in fact, the first iPhone NerdWallet app was a travel app, and it got featured in the App Store – but we never got great adoption, so we ended up killing it. We had an online coupons product that I personally spent a lot of time building that didn’t get traction, so we killed it.

But with all these things, we ended up learning about strategies that paid off. For example, even though our actual coupons product sucked and never produced the results we wanted, we did learn about effective Black Friday and Cyber Monday strategies that netted us amazing SEO and media hits– as well as cash– for years to come.

It’s a good time to be scrappy

When I look back at the struggles Tim and I went through getting NerdWallet off the ground, I am frankly envious of today’s founders. The technical advances to easily automate or outsource work we had to suffer through are a real boon to today’s startups.

Take coding. Back in the day, we did it all (terribly) ourselves. Today, there are ways to automate building that would have saved us countless sleepless nights. You don’t even have to know how to code to build software now. With no-code tools and recent developments in AI, you could do in one weekend what took us months, if not years.

The same is true for design, marketing, and HR (once you’ve built a product that can afford to hire employees). Fifteen years ago, none of that existed. Founders can sidestep a host of startup headaches we faced in 2010.

We managed our own servers before we discovered Rackspace, and then AWS. We wrote all of our own code in PHP and JS before we discovered web frameworks and Javascript libraries. We wrote our own web crawlers before we found SEOMoz and Semrush. We did our own accounting, our own employee onboarding, our own payroll, set up our health insurance and 401k from scratch. Meanwhile, every aspect of building that business is automatable today.

And in fintech specifically, the rise of embedded fintech and infrastructure providers like Unit (disclaimer: BTV is an investor) has lowered the barriers substantially, even in highly-regulated industries like banking.

Another major benefit today is the maturity of the tech market in the US. When we got our start, the word “fintech” wasn’t even in the vernacular. And part of the reason we bootstrapped is because we were pretty sure no VC would’ve backed a couple of nobodies from Wall Street with negligible technical chops and a business model that largely consisted of, “We’ll intentionally monetize our users less than the competition.”

By 2021, $1 out of every $5 of funding from venture capitalists went to fintech startups, and now successful founders come from all walks of life and from all over the globe. This is another reason we built Better Tomorrow Ventures and then launched The Mint program, where we provide fintech startups with $500,000 in pre-seed funding and three months of intensive 1-on-1 mentorship tailored to the unique challenges and opportunities in this space.

Try this thought experiment

As Will Quist’s post notes, “The ‘f*ck around and find out’ round was actually super important. Raising less capital with less expectations lets founders get going with a wider aperture, a wider margin of error, AND the ability to shut it down/move on sooner if the thesis doesn’t track.”

So before you go out to market and say, “I need $2 million to last 24 months,” maybe run the thought exercise: Do you? Do you really? What is the one thing you need to prove today for this to become a huge company down the line? And what would you do if you only ever had access to $500,000 to prove that? What if it was $0? How high could you set your sights? How fast could you go, and how far could you push?

If you set those constraints, you might be surprised by what you learn about yourself.